Our Services

SErvices

We Apply Expertise

Our expertise tends to be revolutionary with the kinds of services we offer. We always strive to put our full potential into all we do and the projects we undertake speak for themselves. Our expertise in the field is also unmatched and can be vouched for by our employees and customers alike.

Direct Debit

The most successful, economical, and easy method of obtaining recurring payments from a large number of clients is through direct debit.

Our flexible and industry-leading Direct Debit solution enables the collection of payments at various intervals and on every day of the month. As a consequence, you and your clients will receive a service that is straightforward, secure, and quick.

Credit & Debit Cards

Maximise income and reduce arrears by giving your customers the widest range of options to pay bills. Our systems for collecting payments offer ease, security, and flexibility, including next-day payment files for easy reconciliation.

Being PCI DSS certified is something we are proud of because it is essential in the modern payment card business. With our certified goods and sector knowledge, we are a trusted partner to protect your business from onerous compliance requirements.

Cash

We collaborate with the two largest over-the-counter payment networks in the UK, PayPoint and Post Office, offering your clients access to over 40,000 locations where they may conveniently pay their bills in cash.

Prepaid Cards

We have been a leader in the usage of prepaid cards in both the public and commercial sectors since 2009, providing disbursement solutions to banks, housing organizations, charities, and local governments.

The Prepaid Card from allpay is a prepaid Mastercard that may be used to make purchases up to the amount stored on it. No credit or overdraft facility exists. Purchases of goods and services can be made in-person, online, or over the phone. The card's every transaction is tracked and logged.

Open Banking

A number of changes to how banks handle your financial information are part of Open Banking.

It gives you a safe way to share your information, so all banks regulated in the UK must permit you to share your financial information, such as spending patterns, regular payments, and businesses you use (basically, your bank, credit, and savings statements), with other banks or authorized providers of products like budgeting apps, as long as you give them permission to do so.

Ready To Accelerate Your Career?

All our openings in India are currently filled.

Please check back soon!

All our openings in India are currently filled. Please check back soon!

Direct Debit

Managed Services :

Organizations that are unable to obtain direct sponsorship into the Bacs scheme might use allpay’s Direct Debit service.

Bureau Services :

For businesses who have registered as Service Users with Bacs, allpay provides a managed Bureau service.

Bacs Training :

After receiving the Bacs training accreditation in 2017, we introduced the Understanding Paperless Direct Debits Bacs training program.

Credit & Debit

Call Center

In order to collect funds while you are conversing with clients, our virtual terminal, Callpay, is a payment management tool that enables you to accept and handle payments inside of your contact center.

Callpay offers the ability to set up recurring payments, which decreases customer workload and boosts call center productivity.

Mobile App

Your consumers may easily make a purchase with our Payment App thanks to its unique design, security features, and ease of use.

Customers can download the app from the Apple App Store or Google Play to pay their bills using an Apple or Android smartphone.

Phone & Text Payment

Enabling clients to pay their invoices anytime, any day of the week.

Utilizing Interactive Voice Response (IVR) technology, our Telephone Payment system enables your clients to pay bills via an automated telephone system. Simply dial the offered low-cost phone number from any landline or mobile device. To make a payment, all they need is an authorized debit or credit card and their Allpay reference.

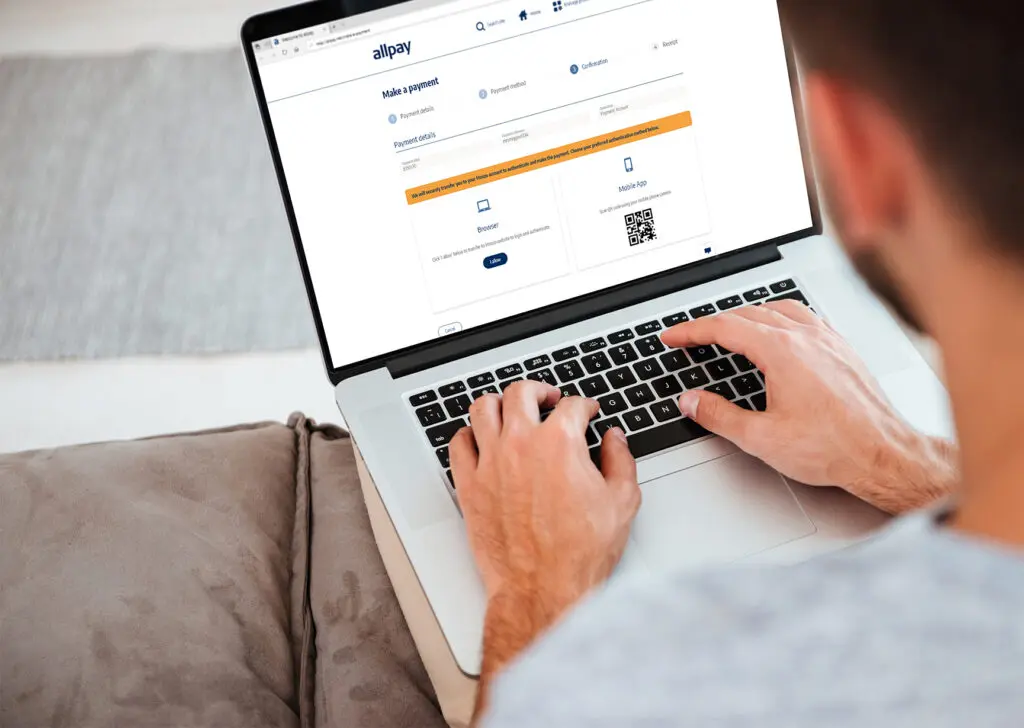

Internet Payments

We provide the option to receive payments using our own site. Customers only need an active debit or credit card, a valid Allpay swipecard, and internet access to start securely paying their bills (debit card only if preferred).

Real-Time Notifications

A product called Real-Time Payment Notifications will notify you in real-time anytime one of your clients has completed a card acceptance transaction. These messages cover refunds, declined payments, and successful payments.

Pay By Link

Pay by Link is a straightforward and secure method for your clients to make payments using their credit or debit cards using a secure Web URL that you give, generally via email or SMS.

Each customer’s Rent/Client Reference Number or Payment Reference Number (PRN) can be added to the Web URL, along with a “suggested” payment amount.

Cash

PayPoint

Customers can always find a PayPoint store because the company runs market-leading national networks with over 29,000 convenience stores in the UK. People use PayPoint in these locations, as well as at home or while traveling, to make necessary payments, access in-store services like parcel drop and collect, and better manage their household finances.

Post Office

With a nationwide network of 11,500 branches, the Post Office® is a preferred option for consumers making recurring payments on council tax and rent accounts.

We are pleased to collaborate with the Postal Service, which has:

- An additional 370 years of service

- More than 11,500 Post Office locations nationally run by locals.

- Over 17 million visits from customers and almost 50 million transactions per week.

Payout

You can more quickly and cost-effectively provide your clients rewards, refunds, or payments by using Payout rather than sending them checks or paying for money transfers.

The Payout product is an improvement to the Allpay cash service that enables you to send cash payments to your customers via their email or mobile phone utilizing barcode technology.

Payzone

By providing clients with convenient over-the-counter bill payment options, the Payzone bill payment service enables independent businesses to boost foot traffic in their establishments. It is regarded as a key partner to the AllPay OTC service with over 500 million bill payment transactions each year.

PREPAID

Prepaid Portals

Our Prepaid solution optimizes accounting efficiency for businesses and provides cardholders with bank account-lite features like direct debits and standing orders while lowering the cost and administration of disbursing payments.

Open Banking

Confirmation of Payee

One of the numerous ways the finance sector is combating Authorized Push Payment (APP) fraud in the UK is through the new industry-wide solution known as Confirmation of Payee (CoP).

In a nutshell, it provides consumers (both personal and business) with more confidence that they are sending payments to the appropriate recipient, reducing the likelihood that payments would be unintentionally diverted to the incorrect account holder.

Confirmation of Payee - Out

With “CoP API – Out,” your company can use Pay.UK standards to send CoP queries to outside parties through a specific, secure API channel and then handle their answer. The product is offered as a SaaS service that combines technical delivery with expert assistance.